Common stock dividend calculator

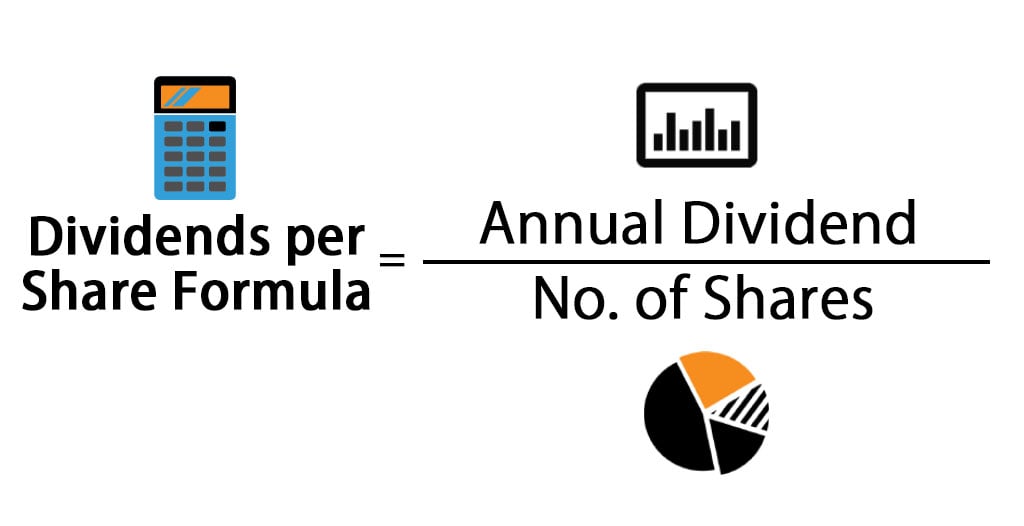

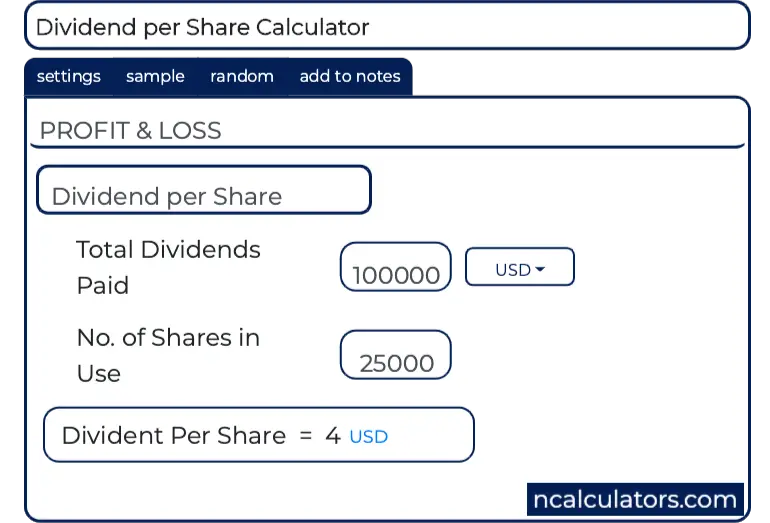

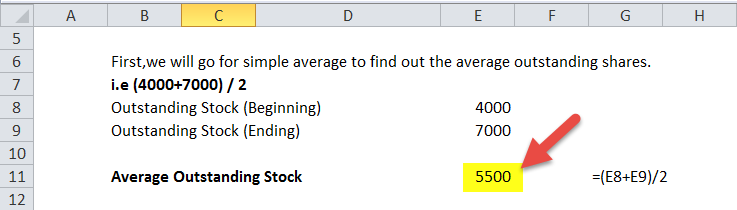

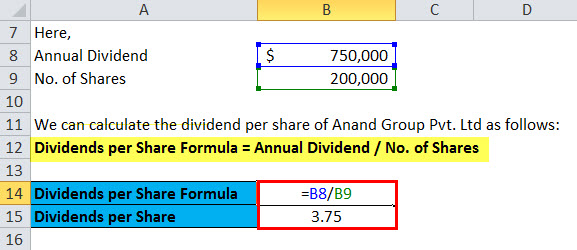

See our Historical Stock Information page for information on splits. We can calculate Dividend per share by simply dividing the total dividend to the shares outstanding.

Common Stock Formula Calculator Examples With Excel Template

Build Your Future With a Firm that has 85 Years of Investment Experience.

. What is dividends-Dividend is a reward money. Ad 1 dividend stock predicted to soar is paying out with a 231 Dividend Yield. The issued stock taken into account is common stock.

Formerly SBC Communications Inc. The formula for common stock can be derived by using the following steps. Calculator assumes all shares purchased were ATT Inc.

Looking to track your dividends. If an investor holds 500 shares of a stock of a. Ad Sharesight tracks true dividend return that your broker doesnt show - try it for free.

This is the most common form of dividend per share an investor will receive. Below is a stock return calculator and ADR return calculator which automatically factors and calculates dividend reinvestment DRIP. Additionally you can simulate daily weekly monthly.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. The Gordon model assumes that the current price of a security will be affected by the. Visit The Official Edward Jones Site.

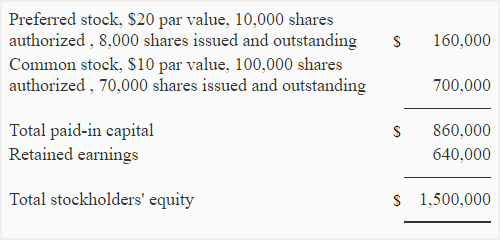

Book value per share Stockholders equity Total number of outstanding common stock. Adjust number of shares. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Sharesight factors in dividends brokerage more. Firstly determine the value of the total equity of the company which can be either in the form of. Lets get started today.

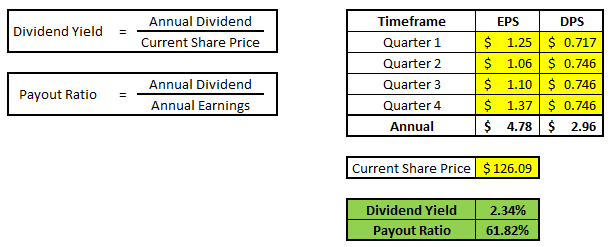

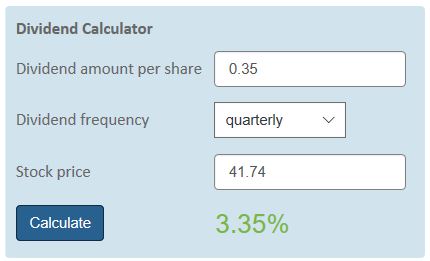

Youre going to take all the numbers you have namely the stock price and the dividend yield and multiply them together. It is simply a cash payment and the value can be calculated by either of the above. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Dividend Reinvestment Calculator As of 09162022. New Look At Your Financial Strategy. Dividends are the distribution of earnings to shareholders prorated by the class of security and paid in the form of money stock scrip or rarely company products or property.

Build Your Future With a Firm that has 85 Years of Investment Experience. You can calculate the dividend yield using the following steps. The company 200000 shares outstanding in its balance sheet.

Find the companys annual dividends using MarketBeat. DRIPs allow investors the choice to reinvest the. Constant Growth Gordon Model.

The top high yield paying dividend stocks for 2022. Have you ever wondered how much money you could. Choose a share price.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Have you ever wondered how much money you could make by. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

Dividend calculation your terms. Shareholders can calculate the dividends on shares they own by multiplying the dividend-per-share by the number of shares in their portfolio. The formula for calculating the book value per share of common stock is.

Declared dividends are the portion of the companys profit that is to be paid to the shareholder. You can also use the calculator to measure expected income based on your own terms. How to calculate dividends from the balance sheet and income statement.

Take the retained earnings at the beginning of the year and subtract it from the the end-of-year. How to Calculate the Value of Stocks. If a companys dividends arent annual multiply the dividend per.

To determine the value of common stock using the dividend growth model you first determine the future dividend by multiplying the current. Preferred Stock is a class of ownership in a corporation that has a higher claim on its assets and earnings than common stock is calculated using Preferred Stock Dividend Discount RateTo. Ad See how Invesco QQQ ETF can fit into your portfolio.

Multiply Those Numbers to Find the Annual Payout. Ad Were all about helping you get more from your money. Here we will discuss how to calculate common stocks and preferred stocks also play a role in calculating common stocks.

However declared dividends are not the. Gordon Model is used to determine the current price of a security. A dividend is a reward to shareholders which can come in the form of a cash payment that is paid via a check or a direct deposit to investors.

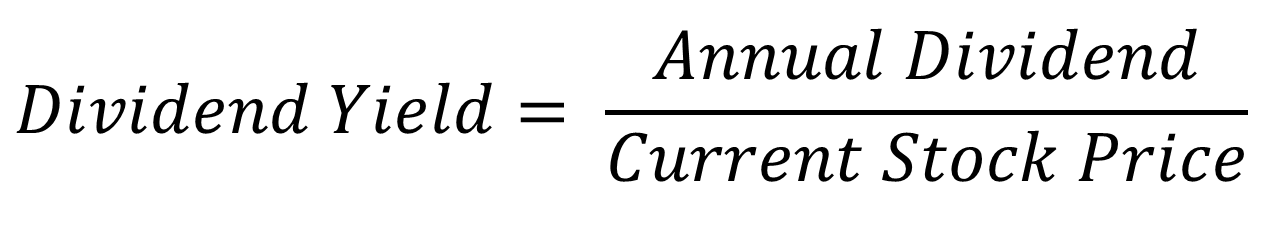

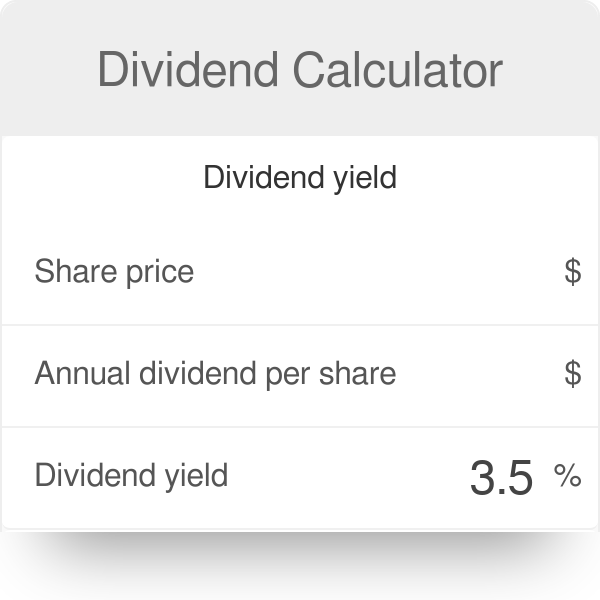

Dividend Yield Formula And Calculator

Common Stock Formula Calculator Examples With Excel Template

Dividend Yield Formula And Calculator

/dotdash_INV_final_Are_Marginal_Costs_Fixed_or_Variable_Costs_Jan_2021-012-68155744a01745e5be2659d6efee6ef9.jpg)

Do I Receive The Posted Dividend Yield Every Quarter

Common Stock Formula Calculator Examples With Excel Template

Dividend Yield Definition And Tips Dividend Com Dividend Com

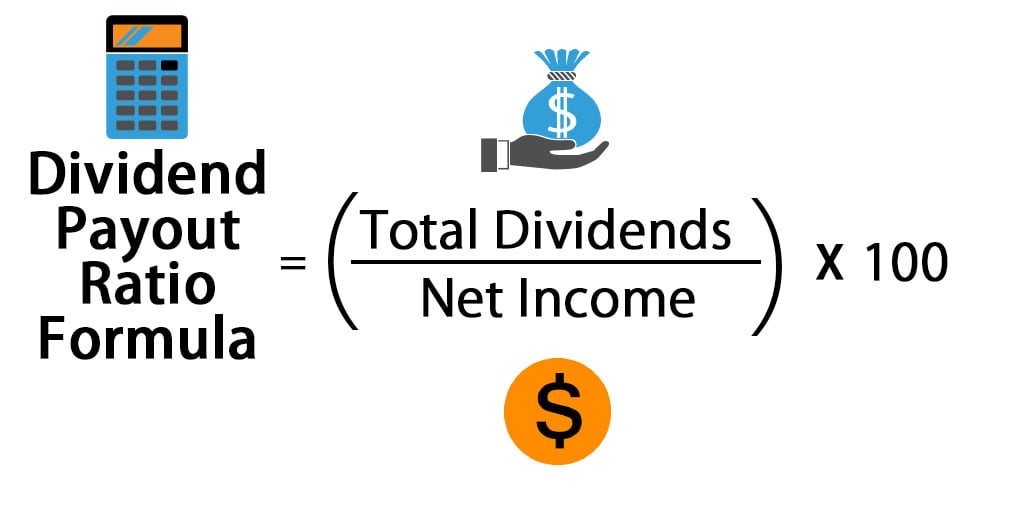

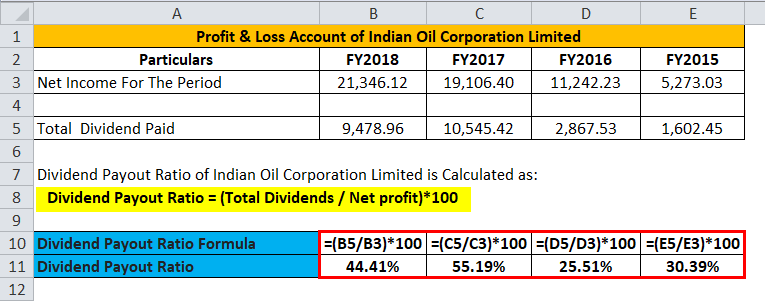

Dividend Payout Ratio Formula Calculator Excel Template

Dividends Per Share Formula Calculator Excel Template

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Dividend Per Share Dps Calculator

Dividend Payout Ratio Formula Calculator Excel Template

Present Value Of Stock With Constant Growth Formula With Calculator

Dividend Calculator Definition Example

Simple Excel Dividend Calculator For Metrics Like Yield And Payout Ratio

Dividend Yield Calculator

Dividends Per Share Meaning Formula Calculate Dps

Dividends Per Share Formula Calculator Excel Template